Bharat Coking Coal IPO Details – Check Date, Price Band, Size

The Bharat Coking Coal (BCCL) IPO is set to open for subscription on January 9, 2026, and will close on January 13, 2026. The issue is a book-built IPO through which the company plans to raise approximately ₹1,071 crore. The IPO consists of a fresh issue of ₹[.] crore along with an offer for sale of up to 46,57,00,000 equity shares, each having a face value of ₹10.

The price band for the Bharat Coking Coal IPO has been fixed at ₹21 to ₹23 per share. The allocation structure includes 35% reserved for retail investors, 50% for qualified institutional buyers (QIBs), and 15% for high net-worth individuals (HNIs). The shares are proposed to be listed on both the BSE and NSE on January 16, 2026, while the allotment is expected to be finalized on January 14, 2026.

On the financial front, the company reported revenue of ₹14,401.63 crore in FY2025, compared to ₹14,652.53 crore in FY2024. Net profit stood at ₹1,240.19 crore in FY2025, down from ₹1,564.46 crore in the previous financial year. Based on the company’s financial performance and business fundamentals, the IPO may be considered suitable for investors with a long-term investment perspective.

Bharat Coking Coal IPO Details

Bharat Coking Coal IPO Market Lot

The minimum application size for the Bharat Coking Coal IPO is 600 equity shares, requiring an investment of ₹13,800. Retail investors can apply for up to 13 lots, amounting to 8,400 shares with a total investment of ₹1,93,200.

Application Lot Size Shares Amount Retail Minimum 1 600 ₹13,800 Retail Maximum 14 8,400 ₹1,93,200 S-HNI Minimum 15 9,000 ₹2,07,000 S-HNI Maximum 72 43,200 ₹9,93,600 B-HNI Minimum 73 43,800 ₹10,07,400

IPO Reservation

| Investor Category | Share Offered | -% Shares |

| Anchor Investor | 11,87,53,500 Shares | 25.50% |

| QIB (Ex. Anchor) | 7,91,69,000 Shares | 17.00% |

| NII Shares Offered | 5,93,76,750 Shares | 12.75% |

| Retail Shares Offered | 13,85,45,750 Shares | 29.75% |

| Shareholder Quota Offers | 4,65,70,000 Shares | 10.00% |

| Employee Shares Offered | 2,32,85,000 Shares | 5.00% |

Bharat Coking Coal IPO Anchor Investors

Anchor Bidding Date January 8, 2026 Anchor Investors List ![]()

Shares Offered 11,87,53,500 Shares Anchor Size 273.13 Cr. lock-in period end date 50% shares (30 Days) February 13, 2026 lock-in period end date 50% shares (90 Days) April 14, 2026

Bharat Coking Coal IPO Dates

The Bharat Coking Coal IPO will open on January 9 and close on January 13. The allotment is expected to be finalized on January 14, with the shares scheduled to be listed on January 16.

IPO Open Date: January 9, 2026 IPO Close Date: January 13, 2026 Basis of Allotment: January 14, 2026 Refunds: January 15, 2026 Credit to Demat Account: January 15, 2026 IPO Listing Date: January 16, 2026 IPO Bidding Cut-off Time: January 13, 2026 – 5 PM

Promoters and Holding Pattern

The promoters of the company are the President of India, acting through the Ministry of Coal, Government of India, along with Coal India Limited. Details of the offer to the public are provided separately.

Particular Shares % Share Promoter Holding Pre Issue 4,65,70,00,000 100% Promoter Holding Post Issue 4,65,70,00,000 90%

About Bharat Coking Coal IPO

Bharat Coking Coal Limited (BCCL), established in 1972, is a leading producer and supplier of coking coal, non-coking coal, and washed coal. In 2014, the company was awarded Mini Ratna status for its role in supplying coking coal to the steel and power sectors. BCCL operates mines in the Jharia coalfield of Jharkhand and the Raniganj coalfield in West Bengal. As of March 31, 2025, the company manages 32 mines, comprising 25 opencast, 3 underground, and 4 mixed mines.

In FY2025, the company’s coal production reached 40.50 million tonnes, accounting for nearly 58.5% of India’s domestic coking coal output. BCCL operates through a combination of open-cast and underground mines, coal washeries, as well as by reopening previously discontinued underground mines and idle washeries to enhance production capacity.

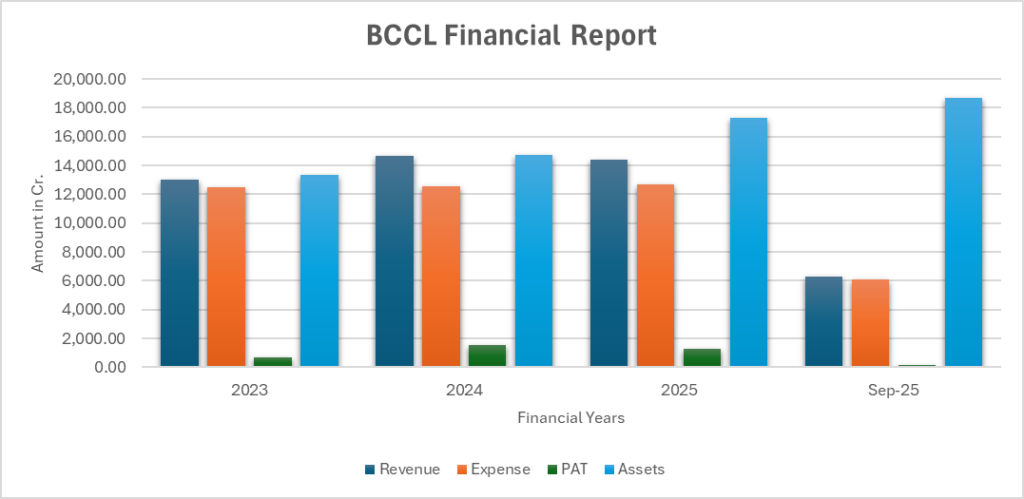

Bharat Coking Coal IPO Company Financial Report

Amount ₹ in Crores

Period Ended Revenue Expense PAT Assets 2023 ₹13,018.57 ₹12,488.38 ₹664.78 ₹13,312.86 2024 ₹14,652.53 ₹12,560.86 ₹1,564.46 ₹14,727.73 2025 ₹14,401.63 ₹12,698.74 ₹1,240.19 ₹17,283.48 Sep 2025 ₹6,311.51 ₹6,112.17 ₹123.88 ₹18,711.13

Bharat Coking Coal IPO Valuation – FY2025

Check Bharat Coking Coal IPO valuations detail like Earnings Per Share (EPS), Price/Earnings P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

KPI Values ROE: 20.83% ROCE: 30.13% EBITDA Margin: 16.36% PAT Margin: 8.61% Debt to equity ratio: – Earning Per Share (EPS): ₹2.66 (Basic) Price/Earnings P/E Ratio: N/A Return on Net Worth (RoNW): 20.83% Net Asset Value (NAV): ₹14.07

Peer Group Comparison

Company EPS PE Ratio RoNW % NAV Income Alpha Metallurgical Resources, Inc 1,233.78 14.87 11.48% 11,182.10 25,320.27 Cr. Warrior Met Coal, Inc. 410.12 19.44 12.82% 3,423.71 13,058.93 Cr.

IPO Lead Managers aka Merchant Bankers

- IDBI Capital Markets Services Ltd.

- ICICI Securities Ltd.

Company Address

Bharat Coking Coal Limited.

Koyla Bhawan, Koyla Nagar,

Dhanbad Jharkhand,

India – 826005

Phone: 0326-2230190

Email: cos.bccl@coalindia.in

Website: https://bcclweb.in/

IPO Registrar

Kfin Technologies Ltd.

Phone: 04067162222, 04079611000

Email: bccl.ipo@kfintech.com

Website: https://ipostatus.kfintech.com/